Will Texas Bitcoin Mines Hurt Power Customers?

Texas is known as one of the most business-friendly states in the US. So, when China kicked out cryptocurrency miners in May 2021, they all flocked to Texas for its cheap electricity. Crypto miners use thousands of stripped down home computers running 24/7 usually in one room. So, they use massive amounts of energy. Now, so many crypto miners operate in Texas that within a few years they will use almost as much power as Houston. Bitcoin is the best known of all cryptocurrencies. Texas Bitcoin mines that draw massive power amounts daily is concerning since ERCOT had trouble meeting demand this summer. However, ERCOT is working with crypto miners to better meet peak demand in the future.

Sweet Deal For Texas Bitcoin Mines

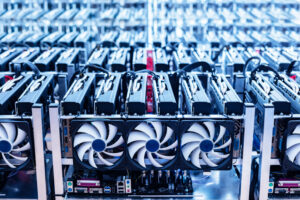

Crypto mines run 24 hours per day using rooms of racks packed thick with computer hardware. These mines guzzle power for both computing and cooling. From outside, these mines run by big firms resemble industrial parks filled with warehouses. As many square feet as possible house the energy sucking computer hardware.

These operations often use power from green energy sources like solar and wind. Alas, these energy sources vary in production. Solar farms don’t make as much power on cloudy days, and wind farms depend on the force of the breeze at any given time. Since the crypto mines need a constant supply of electric power, ERCOT saw an opportunity.

Under a voluntary agreement between ERCOT and crypto miners, the miners agree to stop running when ERCOT needs help meeting demand from electric companies supplying homes. In return, ERCOT buys back the power miners would have used. Some crypto miners see this as a golden opportunity for a side hustle. And they’re probably spot on.

In July, Riot Blockchain earned more by selling power than mining crypto. The company followed the old stock market adage, “Buy low. Sell high.” They sold electricity during a peak demand period at market prices. Critics argue that crypto miners are being paid for a problem they created. Absent the crypto miners, power demand would have been much lower.

Community Concerns

Some people who live near Texas Bitcoin mines are concerned about the impact to their towns. The mines’ hungry use of electricity and water leave ordinary people wondering how home utility bills might change. Through an Economics 101 lens, upping demand without comparably raising supply means prices will go up. But by how much and when are anyone’s guesses. And will increasing demand persuade generators to increase output? That would certainly help reduce current Texas electric rates.

Under the deal between ERCOT and the crypto miners, the Texas grid’s reliability should improve. This gives ERCOT another lever it can pull when trying to meet peak demand. Yes, it’s a costly lever, but it’s a viable option.

Reliable Home Power Prices

You may not make out as well as crypto miners, but you can save money on power by shopping at https://www.texaselectricityratings.com. Sign up for a fixed rate electric plan, and you can have reliably low power bills for months to come.