The Best Electricity Companies in Texas

Texas Electricity Ratings provides expert rankings every year. In 2025, the best electricity companies in Texas are Chariot Energy, Gexa Energy, Payless Power, Constellation Energy, and Frontier Utilities

Shop Plans In Your Area:

2025 Ratings - Best Electricity Suppliers

Texas Electricity Ratings provides expert ratings of energy suppliers in Texas.

We use our decades of combined experience in the Texas electricity market to evaluate Texas electric companies on a variety of factors. We review customer service, plan selection, deposit policies, customer service quality, customer reivews, and other indicators to determine how a given electric provider stacks up against the competition.

After we compile the data, we boil it down to a few key areas, and give each area a score between 1 and 5, with 5 being best.

Based on those ratings, we award Gold, Silver and Bronze awards to the best suppliers.

Recommended Electricity Plans

Companion Savings + Benefits 12

- 12

- monthsmo.

- Avg. BillAvg.

- $94

12 Month Usage Bill Credit

- 12

- monthsmo.

- Avg. BillAvg.

- $148

Electric Companies in Texas

This is a list of active electricity providers in Texas

Each REP in Texas tries to offer something different and unique to their customers. They might have Rewards programs for loyal customers. They could offer special products for your home that improve your energy efficiency. Or they might just try to get you a low rate with no frills! (Hey, who doesn't like a good deal!). To compare these plans and products, think about what kinds of things are important to you - then we can help you find the right company and product for your situation.

How Texas' Electricity System Works

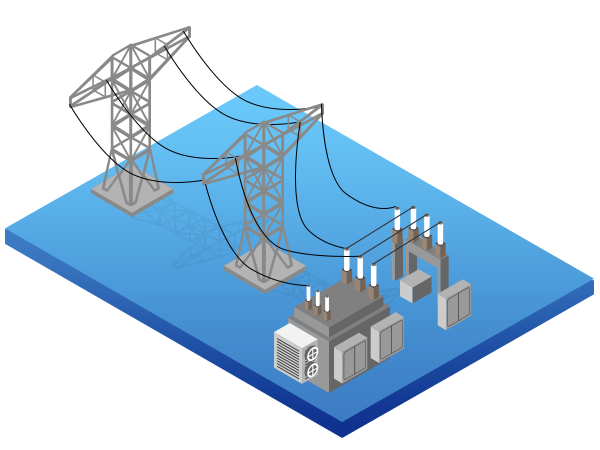

There are actually three different kinds of electricity companies in Texas that work together to supply electricity to your home. Generally, you'll be interacting with a "Retail Electricity Provider" (REP for short), which provides retail electric plans to consumers and handles the billing and customer service aspects of your service. Behind the scenes, the TDSPs and generators will get the power routed to your home safely and reliably.

Texas Electricity Generators

Electricity Generators build and maintain the power plants that feed power into the Texas electricity grid, which is then sold to Retail Electricity Providers.

Transmission/Distribution Service Providers (TDSP)

The TDSP maintains the meters, wires, poles, and underground cables that bring the electricity from the generators to your home. The TDSPs are also responsible for reading your meter and providing that information to your Retail Electricity Provider (REP).

Retail Electricity Providers (REP)

Retail Electricity Providers provide customer service, billing, and payment functions to you, the consumer. They create different brands, plans, and products to meet your unique lifestyle needs as a customer. They purchase electricity on the wholesale market from the generators and make sure you are properly billed for the amount of electricity you use.

Texas Electric Utilities

Frequently Asked Questions About Texas Electricity Companies

The REP is the 'electric company' you interact with. These retailers provide enrollment, billing, and customer service functions to electricity consumers.

They purchase electricity on the wholesale market and sell it to commercial and residential users.

'TDSP' is short for "Transmission and Distribution Service Providers". The companies are responsible for maintaing the poles & wires to get the power to your home.

If you have a power outage, you should contact your TDSP, so they can troubleshoot the physical problem with your power.

ERCOT is short for "Electricity Reliability Council of Texas" They are the governmental entity responsible for managing the Texas electricity grid. They forecast electricity needs across Texas and coordinate with the generators to make sure there is steady, sufficient power to keep everyone's lights on. ERCOT is also responsible for enforcement of the consumer protection laws put in place when Texas deregulated it's electricity market.

The companies operate the power plants and renewable energy installations that generate all the electricity. They sell this electricity on the wholesale market to your electricity company (also called a 'Retail Electric Provider' or REP for short).